2025 HBM Outlook – How is SK Hynix preparing for HBM?

Wouldn’t HBM still face a supply shortage?

The Emergence of HBM4 and Its Anticipated Impact

1. Increasing Capa Encroachment with HBM4

As HBM generations advance, their wafer capacity (Capa) encroachment effects grow larger. The upcoming HBM4, set to debut in the second half of 2025 (2H25), is expected to amplify this trend.

• Increase in I/O Terminal Count: HBM4 is designed to feature 2,048 I/O terminals, doubling the count from previous generations. While this boosts data transfer rates, it also increases the physical size of the semiconductor.

• Higher Wafer Requirements: Previously, the wafer consumption ratio of HBM compared to general-purpose semiconductors was approximately 1:2.5~1:3. With HBM4, this is projected to exceed 1:3.

HBM4’s high capacity requirements mean that sample submissions will begin in 2H25, with mass production sales starting in Q4 2025 (4Q25). To prepare for this, significant Capa adjustments are expected to begin in Q2 2025 (2Q25).

2. Will Production Capacity Be Enough by 2026?

HBM4 will be first adopted by Nvidia’s next-generation AI GPU platform, Rubin, which is slated for release in 2026. To meet the expected demand, HBM4 supply must be significantly expanded from the first half of 2026 (1H26).

• Increased Need for Capa Investment:

HBM4’s higher wafer consumption will necessitate additional Capa investments during the production line transition.

• Higher Difficulty in Yield Optimization:

With a doubling of I/O terminals and tighter TSV (Through-Silicon Via) arrangements and die spacing, production complexity increases substantially. Even with sufficient Capa, achieving stable yields remains uncertain.

3. The Importance of Preventive Investment and Production Stabilization

Given the challenges of HBM4 and the difficulty of securing high yields, proactive investments to strengthen production capacity will be essential by 1H26. Satisfying the demand from key customers like Nvidia Rubin will require overcoming technical hurdles and ensuring stable production capabilities.

How Much Will SK Hynix Expand Its HBM Capacity?

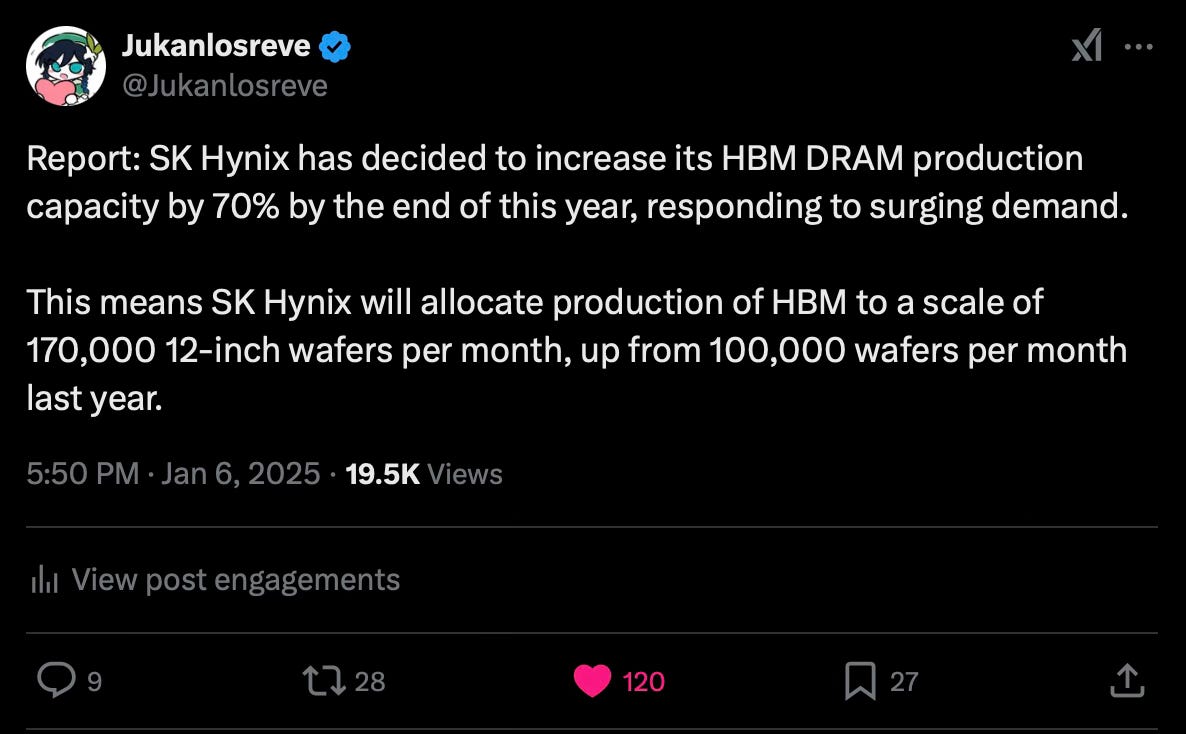

According to a recent report by Sedaily, SK Hynix initially aimed to increase its HBM production capacity to 140,000 wafers per year by the end of 2024. However, the company recently decided to further expand its capacity by an additional 30,000 wafers, bringing the total to 170,000 wafers annually.

• Yearly Production Capacity Growth:

SK Hynix’s HBM production capacity has seen consistent growth, from 30,000 wafers in 2023, to 100,000 wafers in 2024, and now targeting 170,000 wafers in 2025—an increase of 70,000 wafers per year.

A Conservative Outlook from Samsung Securities

While SK Hynix’s expansion plans are aggressive, Samsung Securities provides a more cautious forecast. They predict SK Hynix’s HBM production capacity will reach 155,000 wafers by the end of 2025. Additionally, they note that any further capacity increases reviewed now will likely have limited impact on 2025 sales.

Key Knowledge: HBM Manufacturing Lead Time

HBM (High Bandwidth Memory) is a type of DRAM, and like all memory semiconductors, it requires a lead time for mass production.

• Standard DRAM Lead Time:

It generally takes 4–5 months from wafer input to the final product for standard DRAM.

• HBM Lead Time:

Due to its more complex backend processing steps, HBM requires additional time for production.

If SK Hynix expands its capacity by late 2025, the effects of this expansion are expected to appear in the first half of 2026. This timeline emphasizes the importance of planning ahead in the HBM sector, as the benefits of current investments may take time to materialize.

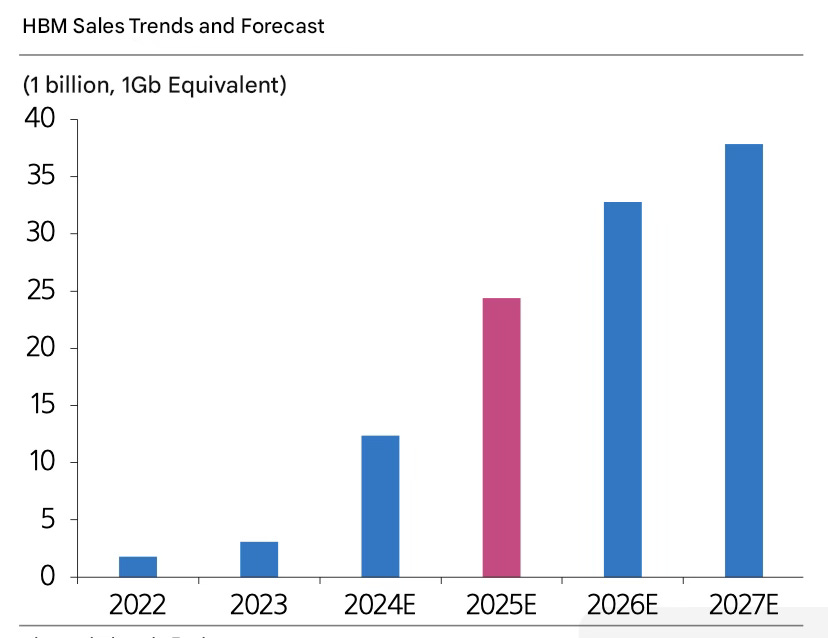

I believe that, much like in 2024 when the majority of DRAM 1b capacity was effectively allocated for HBM production, most of DRAM 1b capacity in 2025 will also be utilized for HBM production.

Additionally, I expect the supply-demand balance for HBM to remain tight at least through the first half of the year, with strong demand for HBM continuing into 2025. Microsoft has announced a FY2025 Capex plan of $80 billion, significantly exceeding initial expectations (consensus: $62.2 billion). This increased investment could trigger FOMO (Fear of Missing Out) regarding AI, potentially leading to increased investments from competitors and other big tech companies.

Bonus: Additionally, I am also providing the Micron HBM CAPA outlook in response to the request.

Very interesting article, thank you.

In the final graph, you show a capacity of 150k wpm for SK Hynix in 2025. But in the text you say SK Hynix is now expected to target 170k wpm capacity in 2025. Why the discrepancy?

Also, why should Samsung become the capacity leader in 2025 given that it is still waiting for NVIDIA to qualify its HBM3E solution? Shouldn't we expect Samsung to take a more cautious approach to HBM capex because of that?

" wafer consumption ratio of HBM compared to general-purpose semiconductors was approximately 1:2.5~1:3. With HBM4, this is projected to exceed 1:3" ...not sure if I get this correct basically this means for HBM you use 2.5 more silicon area and this will increase to >3?

do you have HBM capacities for MU as well for 2023, 2024, 2025 - for SK and Samsung you referenced some numbers

thx