Samsung Securities’ 2025 Memory Market Outlook

This post incorporates materials from Samsung Securities.

Samsung Securities has released a useful report, so I’m sharing it here.

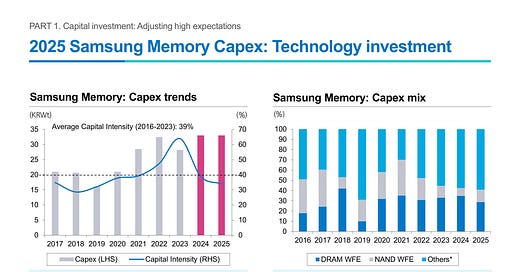

First: Samsung Electronics’ 2025 Memory CAPEX Outlook

A notable point is that in 2025, the plan is to reduce short-term production investments and increase process transition-focused investments to adopt more advanced nodes

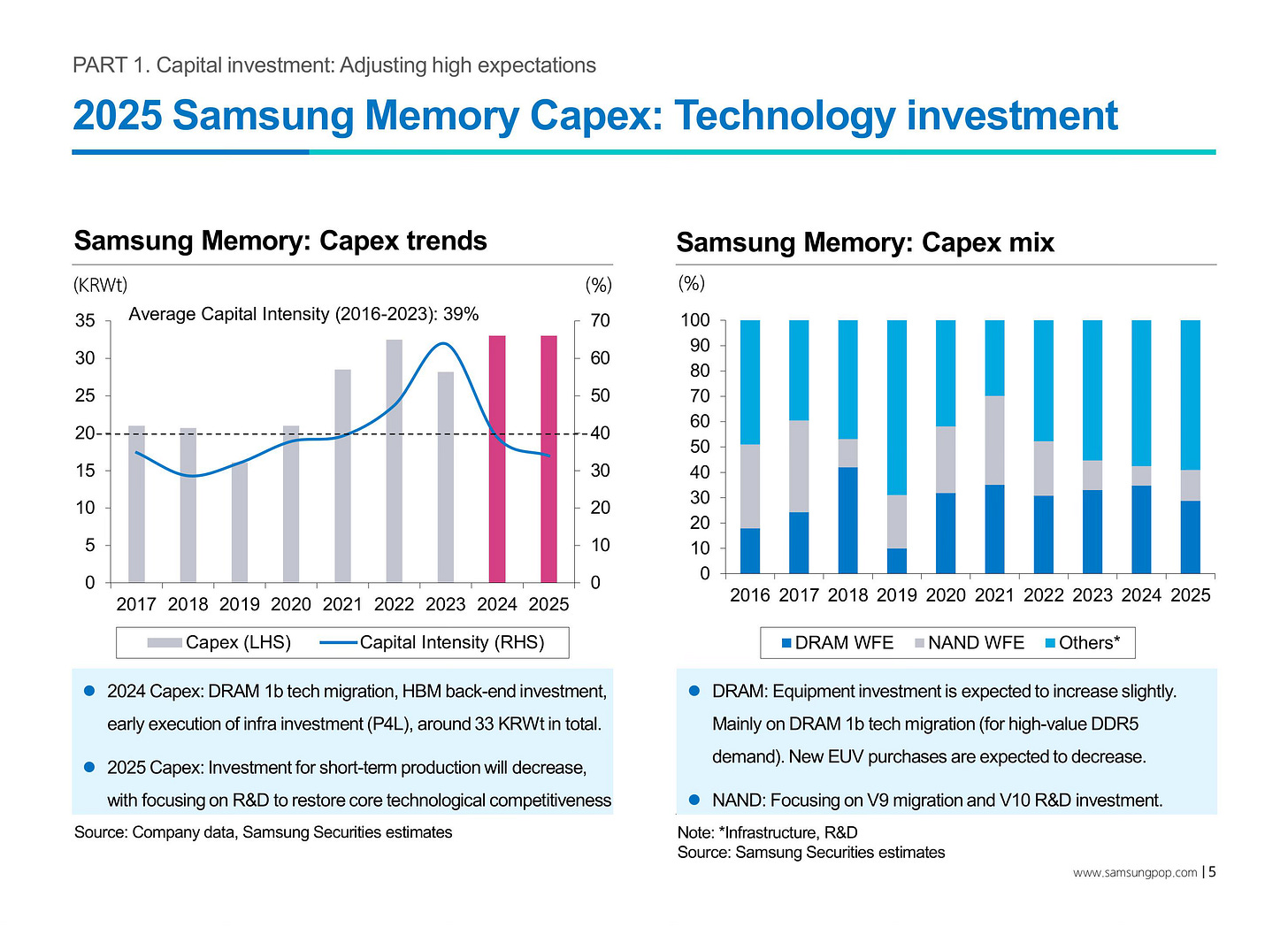

2. SK Hynix CAPEX Outlook

To interpret overall:

• SK Hynix is focusing its investments on upgrading HBM and DRAM technologies while adopting a conservative approach to NAND investments.

• This appears to be a strategy aimed at flexibly responding to market demand, particularly to minimize the risk of oversupply and strengthen financial stability.

• The plan to enhance competitiveness in NAND technology through advanced node transitions is also clear.

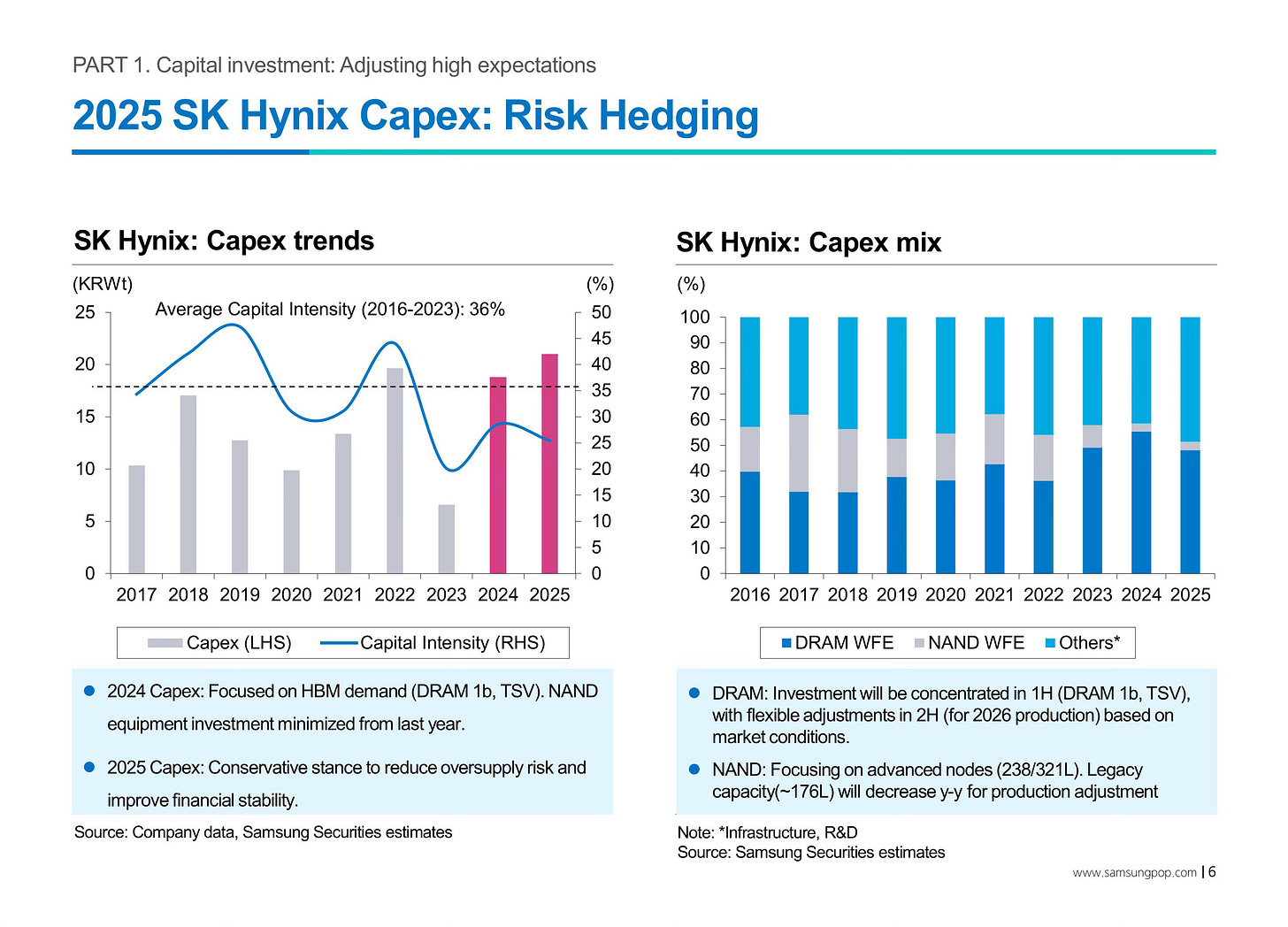

Micron CAPEX Outlook:

To interpret overall:

• Micron Technology plans to significantly increase capital expenditure (Capex) in FY2025, which includes the transition to DRAM 1b technology and the construction of new infrastructure (Greenfield Fab).

• Significant fluctuations in capital intensity and growth rate are expected, with concerns over potential overinvestment due to increased infrastructure spending.

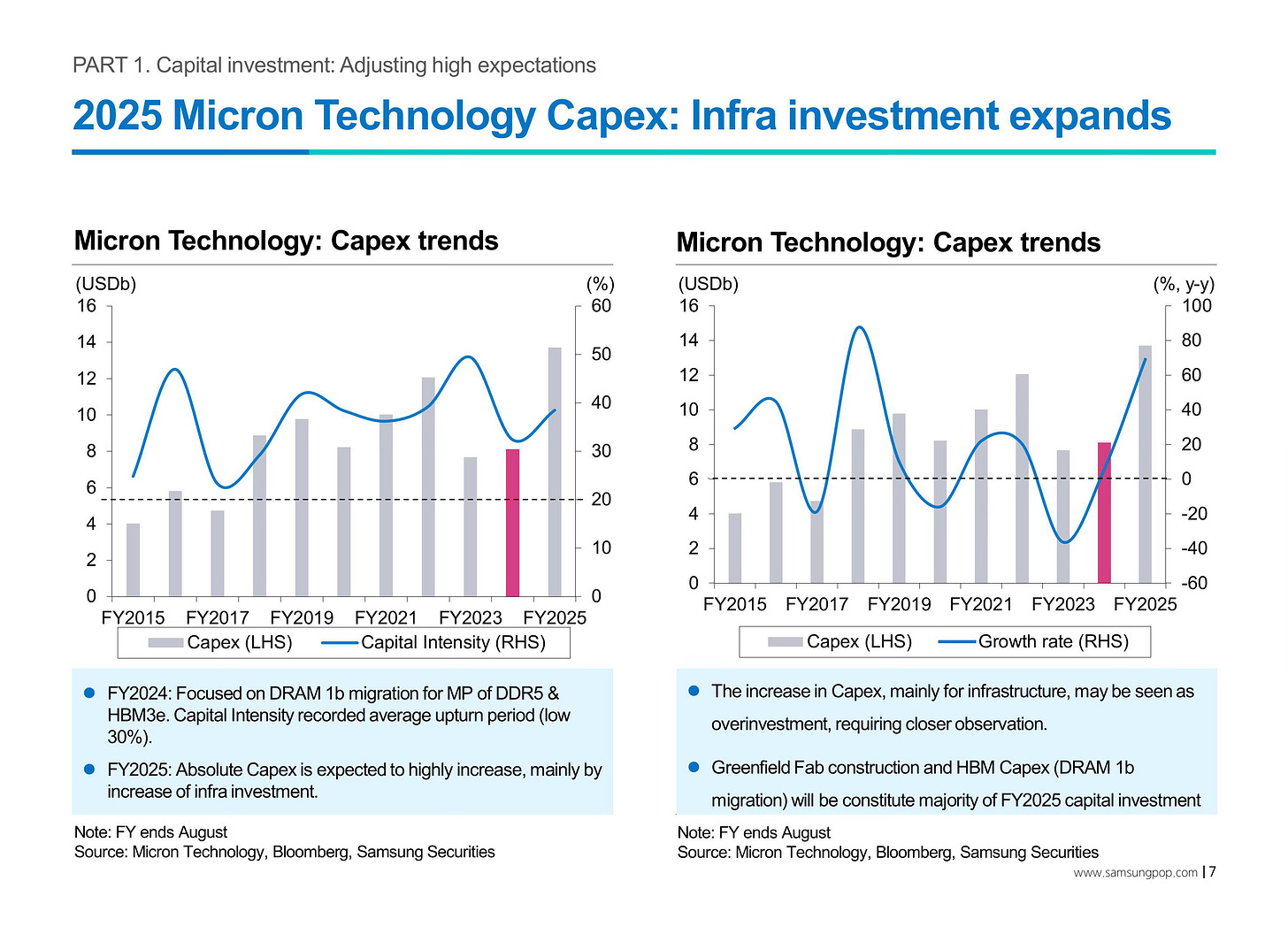

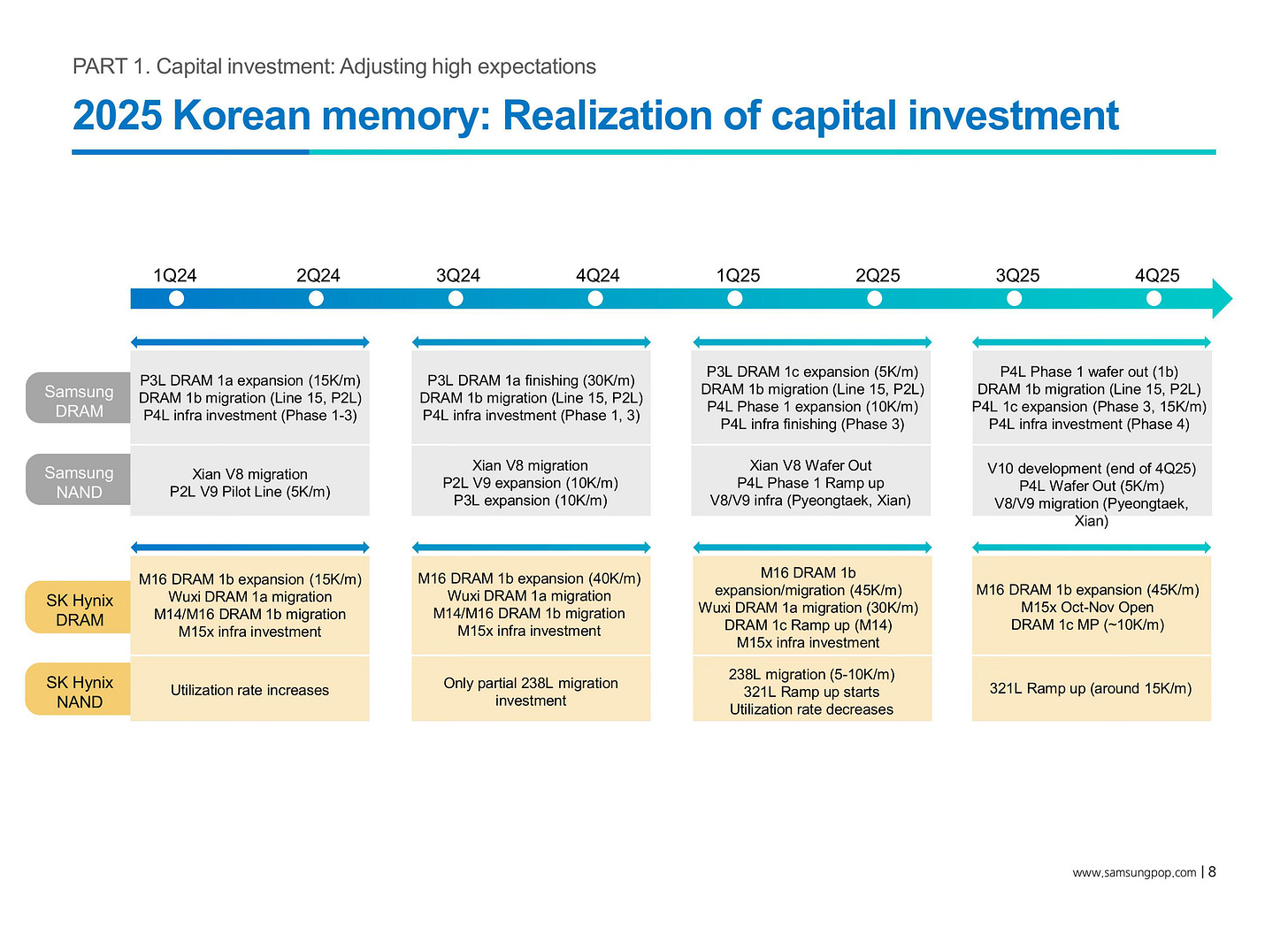

Realization of Capital Investment in the Korean Memory Industry in 2025

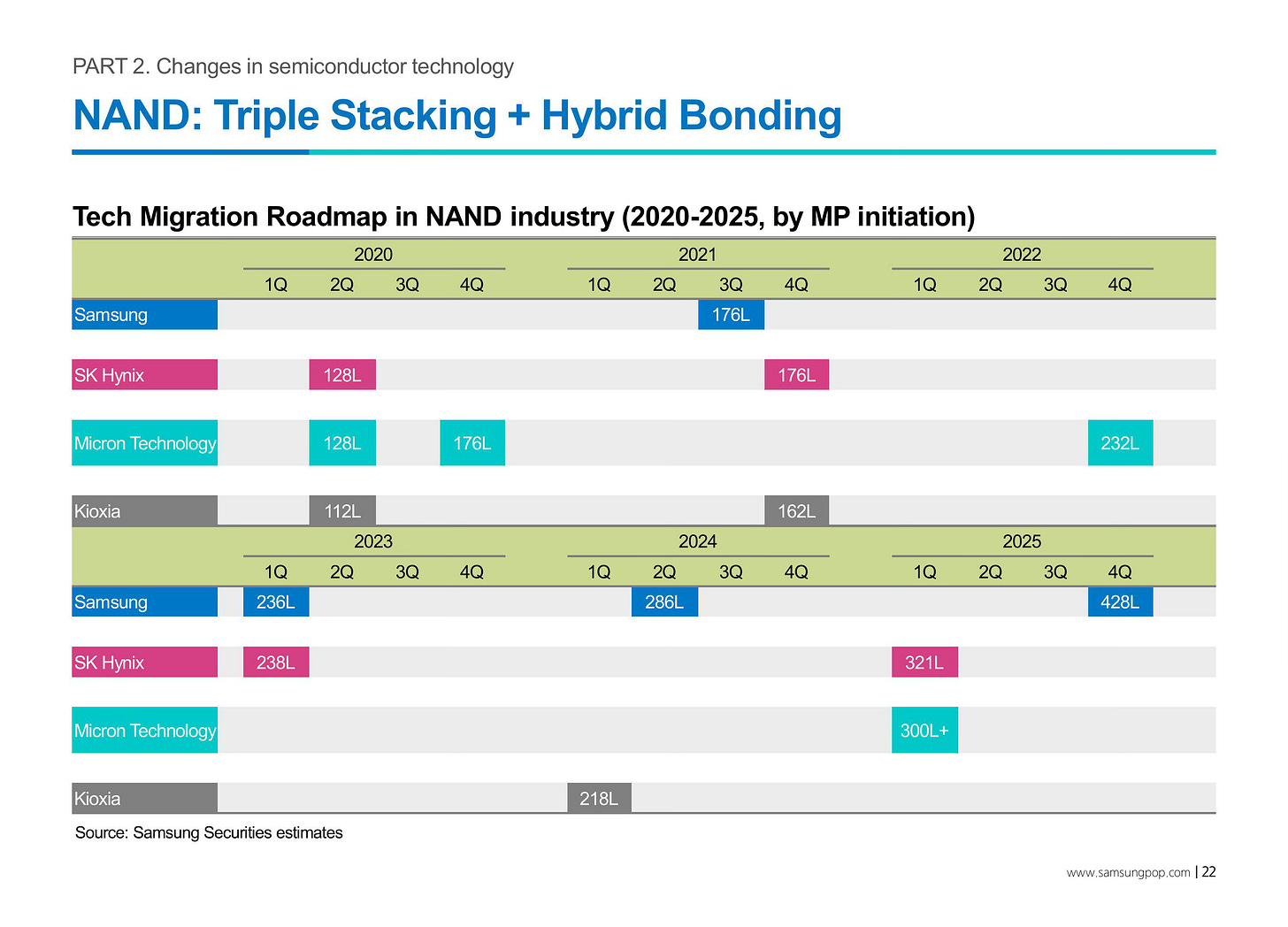

• Samsung is conducting large-scale infrastructure investments and expansions through the transition to DRAM 1b/1c and the upgrade of NAND technology from V8/V9 to V10.

• SK Hynix is focusing on the transition to DRAM 1b and NAND 238L/321L technologies, as well as improving productivity.

• Overall, the main direction of capital investment lies in technology transitions and infrastructure development, with continuous ramp-ups and completion of technology advancements scheduled on a quarterly basis.

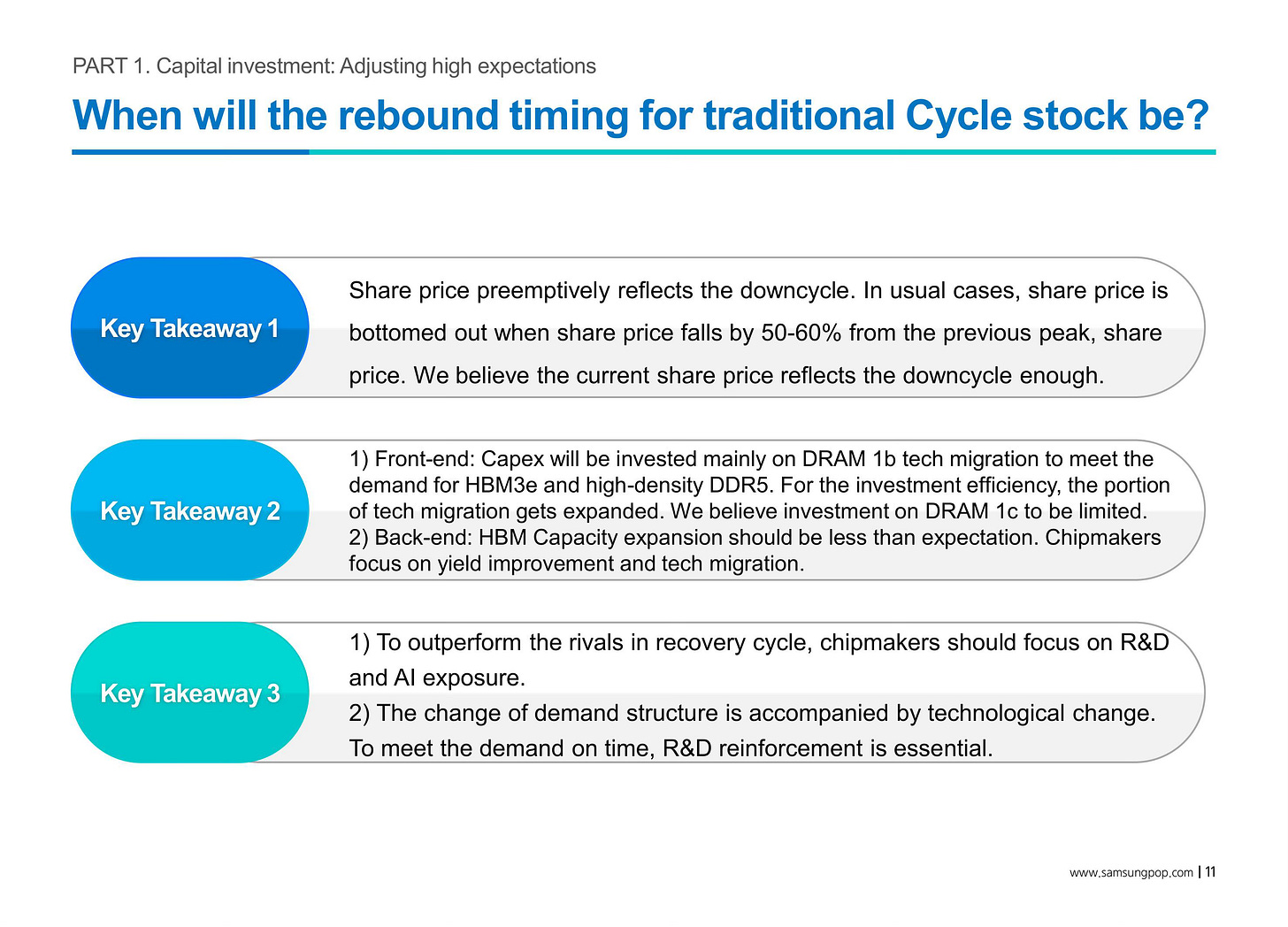

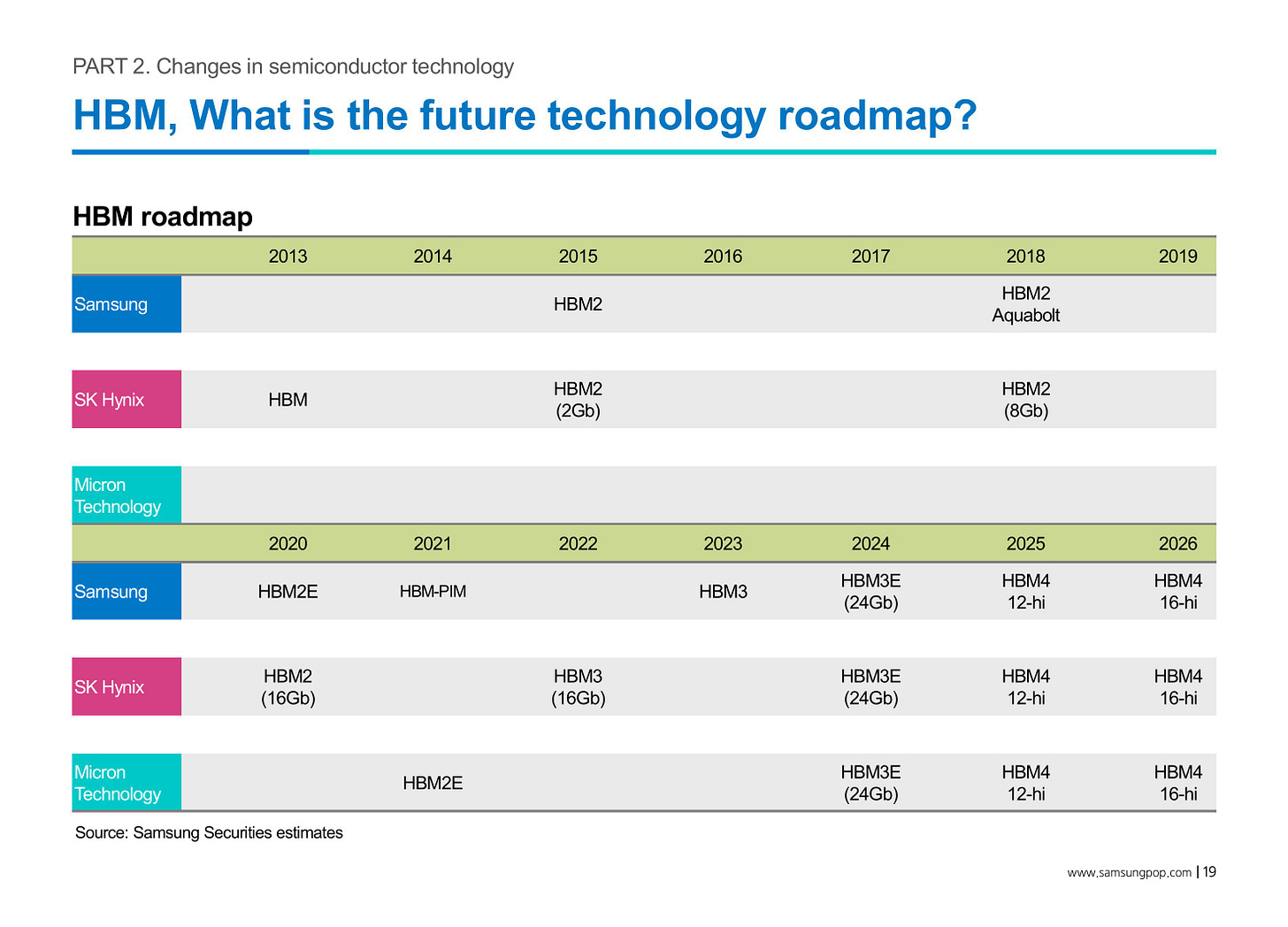

A strategy focused on yield improvement and technology transition in the back-end of HBM

1. Samsung focuses on technology maturity and aims for stable and gradual expansion of production capacity.

2. SK Hynix is preparing for post-2025 by gradually increasing production capacity while improving technology and yield.

3. Micron emphasizes technology transition by remodeling new facilities to simultaneously produce DDR5 and HBM.

Why SK Hynix expands year-end capacity further?

• SK Hynix is increasing HBM production capacity while carefully managing the risks associated with the technology transition to HBM4.

• Leveraging the characteristic of significant yield improvements upon resolving bottleneck issues, the company aims for gradual capacity expansion and risk minimization.

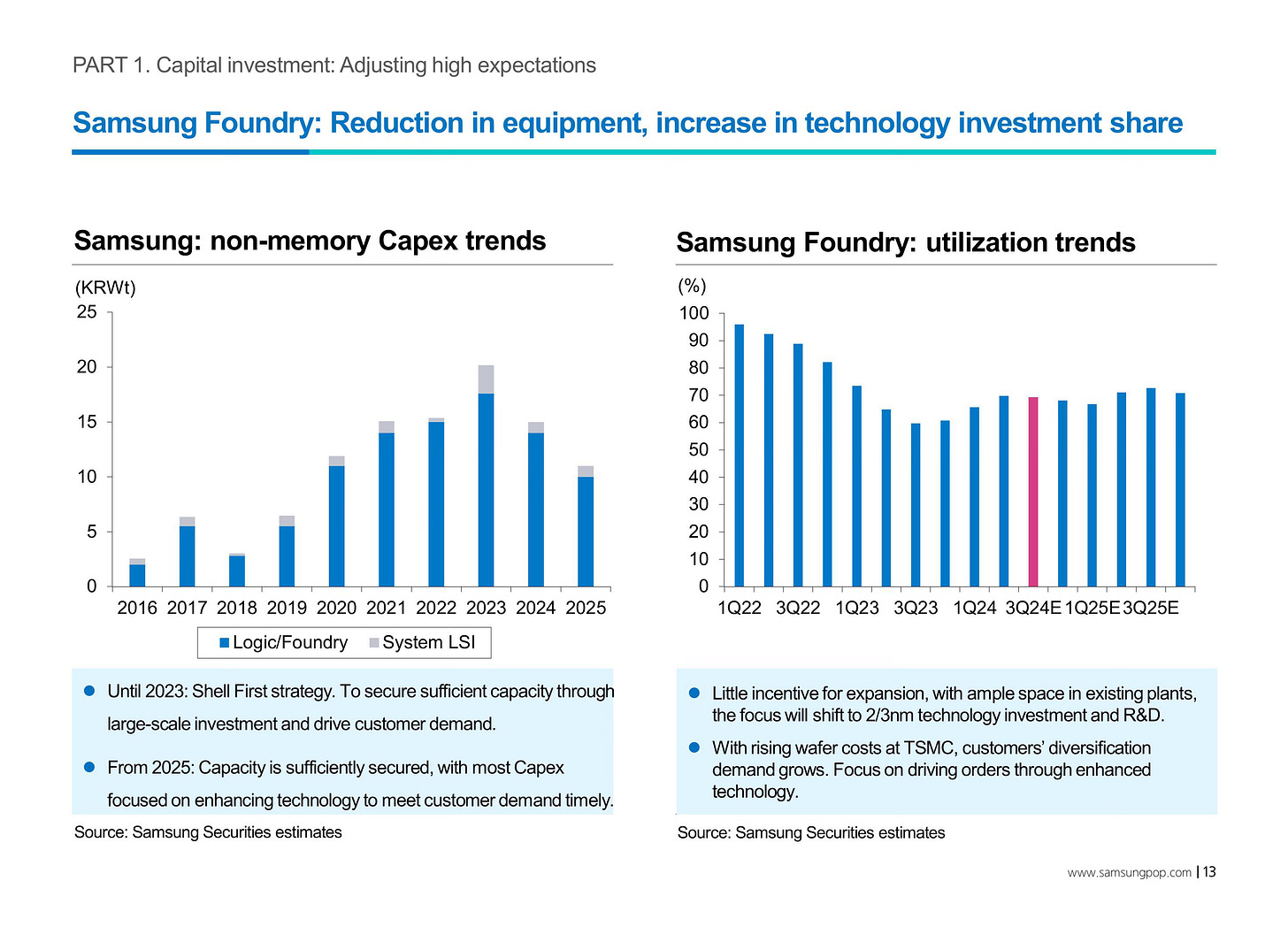

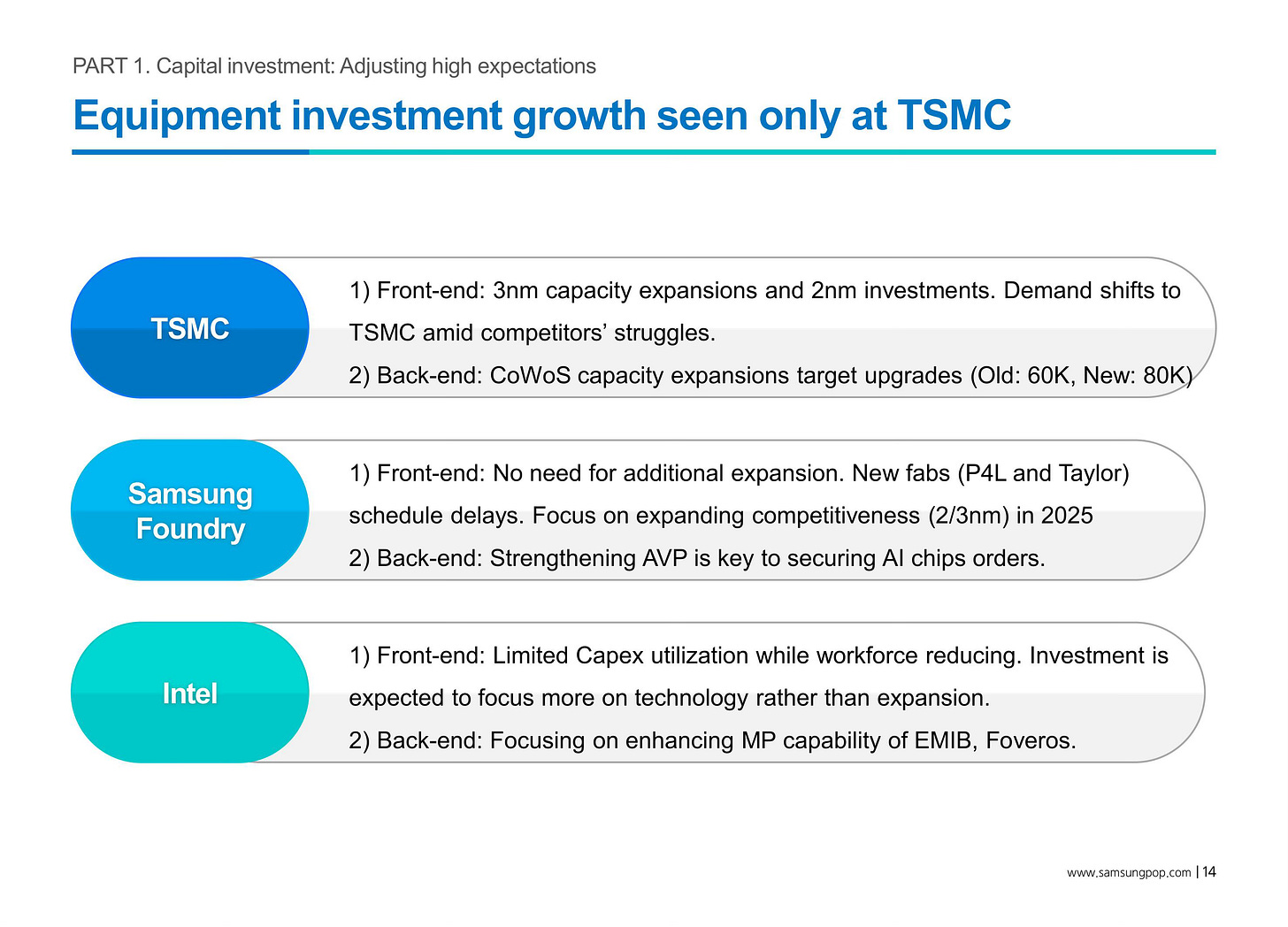

Samsung Foundry Investment Strategy

1. Shift in Investment Direction:

• Moving from investments focused on large-scale capacity expansion in the past to prioritizing technology enhancement and meeting customer demands after 2025.

2. Strengthening Technological Competitiveness:

• Aiming to deliver differentiated value in competition with TSMC through investments in 2nm/3nm technology and R&D.

3. Opportunities for Customer Diversification:

• With TSMC’s rising costs, customers are paying more attention to Samsung’s technology and cost competitiveness.

This is where the highlight begins. Focus carefully.

So how are you investing in the semi market given all this?