2Q Relief Rally: DRAM Price Rebound on the Horizon – Samsung Securities

Deepseek panic hastened the relief rally.

WHAT’S THE STORY?

We forecast a relief rally in Q2: We expect that in the second quarter of 2025, the risk–return profile and price–earnings ratios will be most favorable. The essence of the Q2 relief rally is supply control. The conservative view of legacy product demand is reinforcing confidence in these supply adjustments. In truth, everyone acknowledges that there is little chance of an additional high-growth story emerging in smartphones. However, years of sluggish performance in the smartphone and PC markets have led both investors and suppliers to adopt a pessimistic outlook. With the emergence of AI as a definitive growth alternative, suppliers’ conservative supply plans have earned greater market trust. Even when demand rebounds moderately, suppliers’ priorities and resource allocations remain unchanged, and when demand is revised downward, they have responded with aggressive production cuts without waiting for competitors. The implicit discipline accumulated by suppliers over time is rapidly normalizing the supply–demand balance in the components market. In the stock market, more investors are sensing that the tech sector’s price adjustments—due to weak demand—are more likely to be accompanied by a relief rally rather than a prolonged down cycle. Moreover, evidence that spring is arriving in the market has been pouring in since February.

Trigger:

The Chinese “Old-for-New Electronics Trade-In Subsidy Program” policy acted as the trigger for this relief rally. However, this does not mean that the rally is unfolding solely because of the “Old-for-New Electronics Trade-In Subsidy Program” policy—it is not the essence of the rally. The direction of the relief rally was already set in motion in August last year with the downward adjustment in Chinese demand, in October with suppliers’ CAPEX adjustments, and in December with NAND suppliers’ production rate adjustments.

Early Start:

The onset of the February relief rally is earlier than we originally expected. Of course, it is not unusual for stock prices to react sooner than anticipated. However, in this case, the DeepSeek event has significantly contributed to accelerating the rally. The high-growth narrative surrounding AI accelerators and HBM briefly stalled, prompting investors to flee from the tech hardware sector. In a short time, amid US–China trade disputes, tariffs, and sluggish domestic demand in China, the tech sector became a hopeless arena—legacy demand dropped while AI demand peaked, and panic spread among investors. This rapid reflection of all the negative factors that might have been absorbed gradually in the first half of the year has, in turn, delayed the short-term re-entry into AI infrastructure stocks. The early manifestation of anxiety has marked the beginning of its early dissipation.

Expansion and DRAM Price Rebound:

The stage is now set for stock prices to react significantly even to slight changes. Small shifts in demand and minor adjustments in inventory levels are beginning to be detected, and these subtle changes are expected to trigger a butterfly effect—spreading an atmosphere in which investors broadly anticipate a recovery. The rebound in DRAM and NAND prices is the highlight of this expansion event, and it is already unfolding before our eyes.

Samsung Electronics:

We believe that Samsung Electronics currently represents the pinnacle of pessimism. However, the spotlight has shifted from AI—which was once the domain of the top player—to an improvement in the supply–demand balance of general-purpose DRAM and NAND that everyone can execute well. HBM, which has been in rally mode for over two years, is now showing signs of upward standardization. We consider Samsung Electronics to be the stock to watch most closely.

Quick Conclusion:

There is a reason why the rally is termed a “relief rally” rather than a growth rally. Once the prevailing pessimism dissipates, the rally will come to an end. To reiterate, it is clear to anyone that the possibility of an additional high-growth story emerging from smartphones and PCs is slim. In the long run, this cycle is an AI-driven infrastructure cycle, and the final outcome must be judged based on investments in AI and infrastructure. For investors to enjoy further rallies in Samsung Electronics, the company must certainly overcome the HBM hurdle.

The Butterfly Effect of China’s “Old-for-New Electronics Trade-In Subsidy Program”

Smartphones have begun to rebound. While China’s smartphone market in 2024 saw only a 2% rise, by the second week of February 2025 the market had grown by 8% year-over-year. Admittedly, the low base effect in early January likely played a role. However, since December 2024—when China’s “Old-for-New Electronics Trade-In Subsidy Program” policy (a purchase subsidy system) began to extend to smartphones—smartphone sales surged by 67% year-over-year during the fourth week of the Lunar New Year.

In February, as Qualcomm, MediaTek, and Micron successively reported that Chinese component inventories were being depleted and that the Q1 customer order atmosphere was better than the usual seasonal trend, the recovery of Chinese legacy demand became officially acknowledged in the stock market. Murata noted that legacy IT device demand in 2025 is expected to be better than in 2024—a point that resonates well. Both Murata’s and Samsung Electro-Mechanics’ book-to-bill ratios have started to exceed 1. DRAM orders from Greater China have also been adjusted upward since February. MediaTek directly attributed this demand recovery to the “Old-for-New Electronics Trade-In Subsidy Program” policy and added that not only does Q1 2025 smartphone demand look promising, but the overall 2025 smartphone business is also viewed positively. Of course, given Apple’s continuously declining market share in China, it remains to be seen whether the mix will indeed shift toward high-end products as MediaTek suggests. Nonetheless, based on Chinese smartphone sell-through, inventory declines, and the consistent direction across various supply chains, we believe that the bottoming out of legacy demand is an unmistakable trend.

General-Purpose DRAM Demand and Price Trends

1. Winters Are Always Cold:

The sales volume of general-purpose DRAM for Q1 2025 in Korea is expected to be about 10% lower than in the previous quarter. While demand from general servers—especially in North American hyperscale markets—is stronger than anticipated, the sluggish demand in set markets persists. Both PC and mobile segments are prioritizing the depletion of accumulated inventories, compounded by a seasonal low-demand period. In such an environment, strong sales are unlikely. Given that high-priced server demand remains robust, the price for general-purpose DRAM is expected to settle at a favorable level—down by about 5% compared to market expectations.

On a positive note, during this period of weak sales, it will be difficult for supplier inventories to increase dramatically. If inventories had ended Q4 2024 at a 7–8‑week level, then by the end of Q1 2025, even amid weak sales, inventories are expected to have increased by only 1–2 weeks. In a typical cycle, without the effect of supply cuts, inventories might have risen by more than 3 weeks. However, the production environment is different now. With HBM consuming capacity in advanced process nodes and production adjustments for general-purpose DRAM continuing to focus on legacy products, the likelihood of a dramatic inventory increase—and thus a significant erosion of pricing power over the year—is limited.

2. When the Cherry Blossoms Begin to Bloom, Things Could Change:

A turning point in demand is expected to be reached once again. Even as customers reduce their DRAM purchases, business activity continues, leading to a reduction in held inventories. Historically, a reduction in customer inventories has signaled the onset of a turning point.

• Mobile:

China’s “Old-for-New Electronics Trade-In Subsidy Program” policy has opened up opportunities to replace smartphones at lower prices, which is boosting demand. Cumulative smartphone sales in China are estimated to have grown by 8% year-over-year as of last week, and Chinese local brands—previously burdened by high DRAM inventories—are showing notable improvement (excluding Apple, sales have grown by 10% year-over-year). As sales become more active, the drive to build finished goods inventories may strengthen compared to initial expectations, bringing the normalization of general-purpose DRAM inventories closer. We anticipate that inventories will normalize (returning to 7–8 weeks) around May–June 2025.

• PC:

We believe that the PC segment hit bottom in Q1. Many in the PC industry had already anticipated a bottoming-out of demand and accordingly scaled back their DRAM purchasing plans. It is expected that sentiment will begin to shift from Q2 onward. With preparations for new AI PC products slated for the second half of the year—and with the end of support for Windows 10 potentially spurring replacement demand—the upward movement in orders that had been reduced should start to materialize from April to May.

Is a DRAM Price Rebound Possible in the Second Half?

1. Q2 Price Scenario:

Given that demand from general servers was strong from Q3 2024 through Q1 2025, there may be a brief pause in Q2 2025. In Q2 2025, as more AI servers are set up, general servers might be deprioritized. However, if the baton of demand is passed smoothly, the improved sentiment will continue. With PC recovery expected and smartphones providing support, the sales and price environment should continue to improve. Considering current supply–demand changes, we expect the decline in general-purpose DRAM prices in Q2 2025 to narrow to a low single-digit percentage (early single digits) compared to Q1 2025. With the strong effect of supply cuts, there may even be opportunities for price rebounds among certain set accounts.

2. The Puzzle of a Second-Half Price Rebound:

The pieces of the price rebound puzzle are coming together. If the effects of supply cuts and customer inventory normalization start to align from May to June, the pressure for a price rebound in the second half may intensify. Efforts to allow for moderate price increases while suppressing excessive price hikes may begin, thereby increasing the likelihood of a second-half price rebound.

3. Concentrated Demand, Unreliable Supply:

Even as the possibility of a price rebound rises, the supply of general-purpose DRAM from memory suppliers is likely to remain a lower priority. Ultimately, as the supply of high-end DRAM tightens, customers’ incentives to accumulate inventory will inevitably grow stronger. This is a recurring fate for general-purpose DRAM customers until the tight supply of HBM is alleviated.

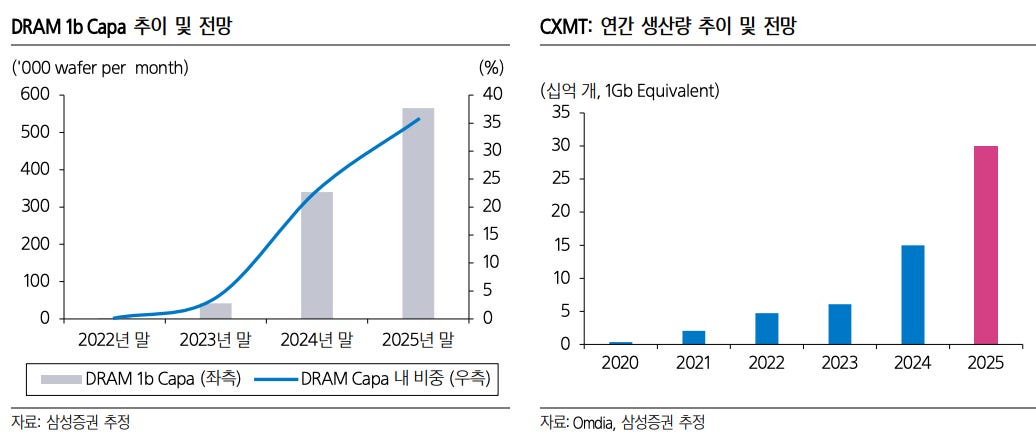

First and foremost, even in the second half, HBM is likely to remain the top priority for memory suppliers. With a consolidation of customers centered around Nvidia, HBM3e is expected to begin appearing in ASICs from Google and Amazon in the second half. HBM customers can still achieve performance improvements by incorporating high-bandwidth, high-capacity memory due to the memory wall phenomenon, and end-market customers such as CSPs are willing to pay premium prices if performance improves. Therefore, HBM is likely to continue to see excessively concentrated demand among high-end products. Conversely, HBM faces a high downside risk in its initial supply growth rate due to sequential capacity expansions (D1b, D1c) and occasional low yields. It is anticipated that by Q4 2025, 60% of SK Hynix’s D1b capacity will be absorbed by HBM demand. Additionally, new high-end products such as SOCAMM and LPCAMM—part of the new LPDDR5X offerings—are also expected to permanently displace some of the D1b and D1c products.

4. Changes in the Mid-to-Low-End DRAM Market:

The true winners of the “Old-for-New Electronics Trade-In Subsidy Program” system are low-end component suppliers. This is because the “Old-for-New Electronics Trade-In Subsidy Program” policy primarily targets demand for mid-to-low-end products priced below 2,000 yuan, rather than high-end smartphones like the iPhone or Huawei Mate series. The phase-out of DDR4 helps delay the threat from CXMT for a certain period. Compared to the stable D4 yields of CXMT, D5 yields remain relatively underwhelming, and recently, difficulties in importing equipment due to U.S. export restrictions have emerged. These import challenges are more likely to constrain D5 capacity rather than D4.

NAND Joins the Recovery Expected Component List

NAND was long plagued by concerns of prolonged oversupply due to supplier productivity improvements and weakened demand. However, the supply–demand situation appears to be improving much faster than previously forecast by the stock market. The main reason is a shift in legacy demand. Unlike DRAM, NAND demand from AI data centers was limited. Demand for mobile NAND and PC SSDs—which account for a large part of the market—was sluggish, and content growth rates notably slowed. Suppliers eventually even lowered their NAND demand forecast for 2025 to 15%. However, following improvements in smartphone and PC demand after January, NAND inventories have begun to decline significantly, a trend that continued into February. In the NAND market, an atmosphere of emerging from the supply–demand bottom is spreading, and once we begin to see reduced channel inventories in Q2, a shift away from inventory accumulation is likely.

Active production cuts by suppliers are believed to be playing a significant role in this shift. Unlike DRAM suppliers—who are attempting to achieve indirect production cuts via HBM—nearly all NAND suppliers have initiated production cuts of 10–20% from the beginning of the year. The effect of these cuts is expected to start positively influencing the supply–demand balance from Q3 onward. The 9% rise in Kyocera’s stock on February 17 is thought to reflect reduced channel inventories and growing expectations of a supply–demand bottom.

Rising Demand for MLCC in Electric Vehicles

The rebound in MLCC is driven by demand from China’s electric vehicle market. Although improvements in Chinese smartphone demand also contribute, demand for MLCC in electric vehicles has been steadily increasing since the beginning of the year. Warmth from rebounding orders is spreading among companies such as Murata, TDK, Samsung Electro-Mechanics, and Taiyo Yuden. Last year, China’s electric vehicle market grew by 33%, which was impressive, and while this year’s growth rate was expected to fall below 20%, a year-over-year increase of around 40% has been observed since the beginning of the year. In particular, as BYD aggressively expands its market share, orders for components have similarly increased. The recovery trend in Chinese smartphones became evident from February and is expected to continue into March. With years of limited aggressive investment in MLCC and an increasing trend in the MLCC content per vehicle for ADAS and autonomous driving, MLCC profit margins in 2025 are expected to improve further compared to 2024.

In the smartphone industry, the growing competitiveness of Chinese local MLCC providers (such as Peace Tech) is increasingly posing a threat to existing MLCC companies. However, for automotive MLCC, where performance, reliability, and established references are paramount, benefits are expected to concentrate among established vendors such as Murata and Samsung Electro-Mechanics.